New reports join the website soon after the data become available to the Department and are available as far back as September 2003. Gross Receipts by Location: Calculation of 1/12% Increment for the Safety Net Care Pool *Page not found Gross receipts are calculated by adding all products.

Decide whether your company uses cash or accrual accounting to determine when sales and income are recognized in your. Monthly Local Government Distribution Reports (RP-500) You calculate your gross receipts by: Choose a time period to measure, such as annual gross receipts and wages per employee. It is impractical to forecast gross receipts for future periods since: (1. Historical gross receipts are not an indicator of future gross receipts.

Monthly RP-80 Reports: Gross Receipts by Geographic Area and 6-digit NAICS CodeĬollection and distribution data of the gross receipts tax are also provided in the Monthly Local Government Distribution or RP-500 reports. Individual total gross receipts will be represented on your K-1 statement in whole dollar amounts (versus on a per unit basis) and may vary from those described below based on your date of purchase.

GROSS RECEIPTS CODE

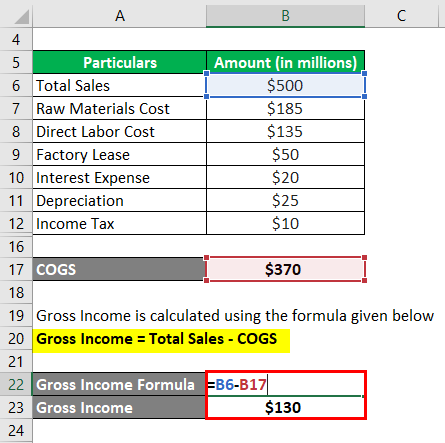

Quarterly RP-80 Reports: Gross Receipts by Geographic Area and 2-digit NAICS Code One format is according to both geographic area and NAICS codes (North America Industry Classification System) called the “RP-80” reports available in this section of the website. Gross receipts include all revenue in whatever form received or accrued (in accordance with the entity’s accounting method) from whatever source, including from the sales of products or services, interest, dividends, rents, royalties, fees or commissions, reduced by returns and allowances. If the number is 0.25 or greater, then your business can demonstrate a 25% decrease in revenue.Researchers, governments, policy makers and other individuals wanting statistical information on the collection of the gross receipts tax can find it in two formats. Subtract the gross receipts of any quarter of 2020 from gross receipts from the same quarter of 2019, and divide that amount by the gross receipts of your chosen quarter of 2019. Percentage decrease 25% OPTION 2 Compare quarterly gross receipts If the number is 0.25 or greater, then your business can demonstrate a 25% decrease in annual revenue. Subtract your 2020 gross receipts from your 2019 gross receipts, and divide that amount by your 2019 gross receipts. The business pays the total Gross Receipts Tax to the state, which then distributes the counties’ and. It varies because the total rate combines rates imposed by the state, counties, and, if applicable, municipalities where the businesses are located.

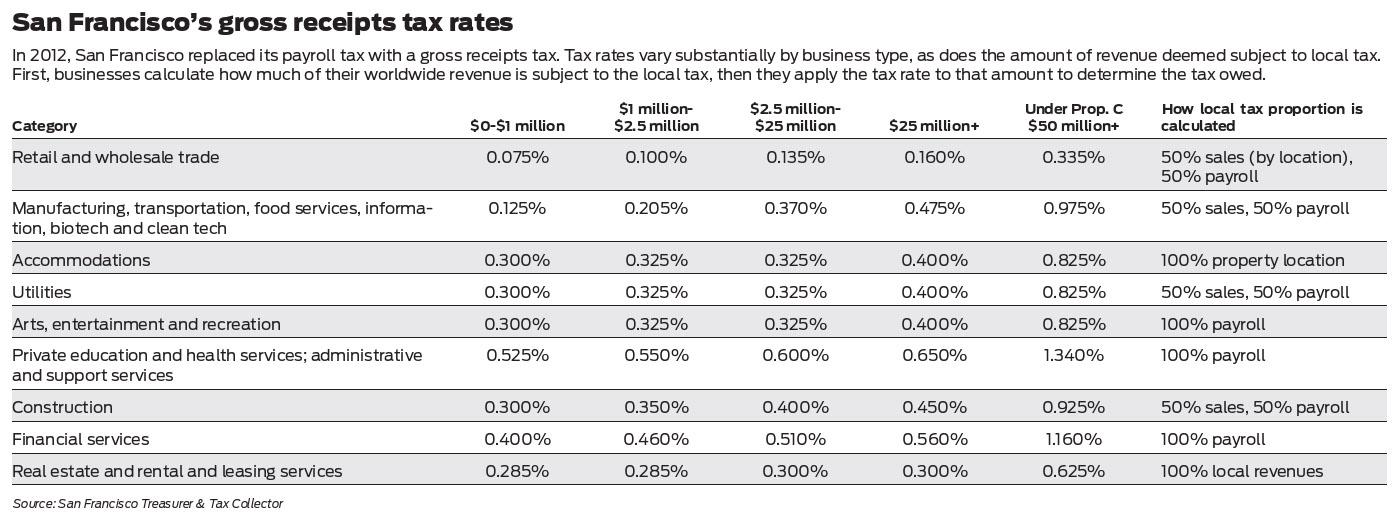

Gross receipts is the total amount of revenue your business has received or accrued in a given period. The Gross Receipts Tax rate varies throughout the state from 5.125 to 9.4375. You should account for all gross receipts or revenue in whatever form received or accrued. Here’s how you can see if your business meets this requirement. OPTION 1 Compare annual gross receipts OPTION 2 Compare quarterly gross receipts FREQUENTLY ASKED QUESTIONSĪccording to SBA guidance, your business qualifies for a second PPP loan if it had at least a 25% decrease in revenue in a quarter in 2020 relative to a quarter in 2019 (or in the year 2020 as compared to 2019). Taxpayers deriving gross receipts from business activities both within and outside San Francisco must generally allocate and/or apportion gross receipts to San Francisco using rules set forth in Business and Tax Regulations Code.

0 kommentar(er)

0 kommentar(er)